Background

Recently, it was announced by MikeMirzayanov that NEAR would be contributing to the funding of Codeforces. Clearly, the influx of additional funding was very important to Codeforces. In this blog I want to look at the NEAR cryptocurrency in more detail, and analyze the possibility of a complete collapse.

The Story of Terra Luna

Between May 5 and May 12th, the cryptocurrency Terra Luna lost all of it's value: wiping $45 billion off of the crypto market.

Between May 5 and May 12th, the cryptocurrency Terra Luna lost all of it's value: wiping $45 billion off of the crypto market.

What were the "fundamental design mistakes" (according to the Binance CEO) of Terra Luna? Perhaps simply the entire idea of an algorithmic stable coin.

A "stable coin" is merely a cryptocurrency whose value is supposed to remain fixed, usually relative to the dollar. For example, the stable coin USDC has had a maximum price deviation of only a tenth of a percent from its pegged value of 1 US dollar.

The so-called breakthrough of Terra Luna was a "decentralized" stablecoin that was not tied to a governmental currency. The blockchain was home to two cryptocurrencies: Terra (UST), which was supposed to be a stablecoin fixed at 1 dollar, and Luna (LUNA) which was supposed to be a normal volatile cryptocurrency.

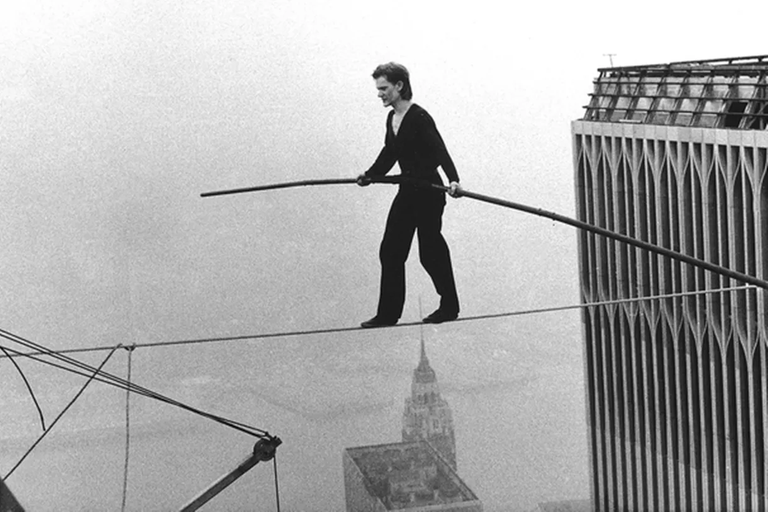

Terra Luna: A Cryptocurrency Balanced on a Tightrope

A sophisticated algorithm linked Terra with Luna. Luna was used to maintain Terra's stability, and Terra's stability was used to preserve Luna. Anyone could "burn and mint" 1 UST, and receive $1 worth of LUNA in return. The final fallback was $3 billion in Bitcoin reserves.

A sophisticated algorithm linked Terra with Luna. Luna was used to maintain Terra's stability, and Terra's stability was used to preserve Luna. Anyone could "burn and mint" 1 UST, and receive $1 worth of LUNA in return. The final fallback was $3 billion in Bitcoin reserves.

A reasonably accurate analogy was that Terra Luna was like a tightrope walker. While the winds were calm the pole would be enough to keep everything balanced.

A Classic Run Ensues

The spark that set off the fire will probably never be known (social media rumors suggested that a massive $1 billion liquidity crunch caused by Citadel was to blame). Anyways, a general downturn in the cryptocurrency market was causing all investors to rethink their crypto portfolios.

As people began to dump their UST holdings, causing massive hyperinflation in LUNA, the peg between the two currencies began to collapse. Attempts were made to save the peg via injecting Bitcoin, but the Terra blockchain simply didn't have enough liquidity to save itself. As it became clear that UST was not going to maintain it's $1 peg (thus making it essentially worthless since its entire point was to be a "stable" coin), both cryptos collapsed in a death spiral together.

The Tragic Aftermath

Both UST and LUNA lost almost all of their value: tens of billions of dollars were wiped off of the cryptocurrency market in approximately a week. Naive attempts to resurrect the Terra blockchain have been dissapointing, and thousands of avid #Lunatics rightfully feel like they were scammed. It became obvious that ALL "stable"-coins are vulnerable to total collapse if they lack the liquidity to maintain their peg to the dollar.

The NEAR Protocol

NEAR is a cryptocurrency based off the #2 crypto Ethereum's blockchain. NEAR's main improvement is that it can process transactions much faster than Ethereum can via technical improvements discussed here. This makes it extremely useful for large-scale projects that need to process thousands of monetary transactions per second. Additionally, 15% of NEAR's original employees were ICPC medalists. :O

NEAR is a cryptocurrency based off the #2 crypto Ethereum's blockchain. NEAR's main improvement is that it can process transactions much faster than Ethereum can via technical improvements discussed here. This makes it extremely useful for large-scale projects that need to process thousands of monetary transactions per second. Additionally, 15% of NEAR's original employees were ICPC medalists. :O

Potential Risk to NEAR?

NEAR itself is not a stablecoin, so it's not going to face the same hyperinflation that happened to Luna. Indeed, there are many technical and economic benefits to NEAR that make it a highly efficient and sustainable cryptocurrency. However, as a relatively small cryptocurrency, NEAR is acutely vulnerable to many of the same triggers that caused the Terra Luna collapse. Indeed, NEAR has lost more value that the mainstream crypto market (75% versus the average market loss of about 50%).

The main issue revolves around "staking". Simply put, staking is like when you invest money in a bank: you get a steady rate of return on the invested money. Whereas Terra Luna had a staking rate of return of nearly 20% (eliciting comparisons to a Ponzi scheme), NEAR has a much more modest rate of return of about 5%.

Approximately 90% of all NEAR coins are currently being "staked". However, investors can withdraw their coins from staking pools in as little as 48 hours. Additionally, their is a "Rainbow Bridge" connecting Ethereum to NEAR.

The fundamental risk to NEAR is, of course, a liquidity crunch akin to the one that destroyed the Terra blockchain. If investors rapidly withdrew their NEAR from being staked and attempted to use the Rainbow Bridge to translate those coins to ETH (which is a much stronger cryptocurrency than NEAR), would the NEAR blockchain have enough Ethereum on hand? I think it's highly unlikely. Additionally, attempts to close the Rainbow Bridge connecting the two currencies would probably only further devalue NEAR. Lastly, many of the technology improvements NEAR repeatedly boasts about may soon become a moot point: very shortly, the long awaited Ethereum 2.0 will be released, that fixes many of the original scalability issues with the ETH blockchain. With ETH completely absorbing the niche that NEAR briefly occupied, it's possible that investors may slowly move away from NEAR.

My Final Words

Of course, I'm highly grateful for NEAR for funding Codeforces in these difficult times for the website. However, I'm highly skeptical of NEAR's longterm prospects as a cryptocurrency, especially given the vivid example of Terra Luna's collapse.

If anyone has thoughts about the NEAR Protocol, please reply to the blog. Thanks!

stay strong, codeforces

That's the scariest rating graph ever!

How much funding does codeforces get from NEAR?

The Rainbow Bridge can't magically convert your NEAR tokens into Ethereum.

I think the main reason near price dropped more than other cryptos is because of USN. USN is an algorithmic stable coin. It is not exactly the same as terra luna (New near will not be minted for USN) but still, if it gets big it can affect near price. People are now afraid of algorithmic stable coins and many will stay away from near because of USN.

I think the chance of the Rainbow bridge bank run happening is very low because you have to pay a high gas fee to use it.